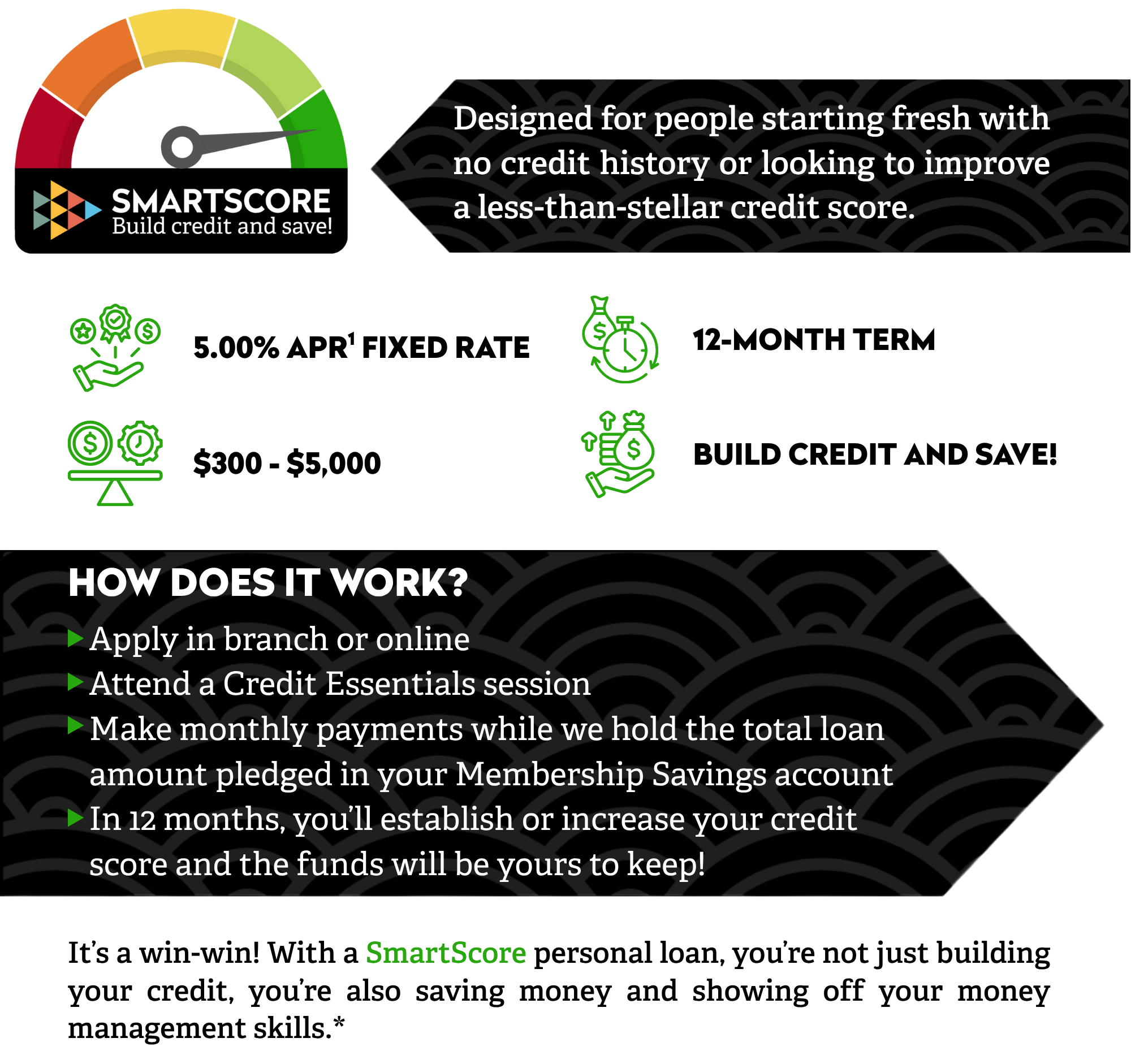

Learn more about the SmartScore Program!

Check out some of our frequently asked questions:

{beginAccordion H2}

What do I need to apply?

Must be at least 18 years old and have a minimum of three months of employment.

What’s a Credit Essentials session?

The Credit Essentials session offers insights into healthy financial habits, tips for improving your credit score, and information about the SmartScore program and its benefits. You can attend a session before or after applying for SmartScore. Attendance at a session is required for loan closing.

What documents do I need to apply?

Identity verification documents, such as a Driver’s License or Government-issued ID. You may also be asked to verify employment. Proof of income is required to determine your ability to pay.

Can I apply with no credit?

Yes! The loan is designed for individuals with no credit or those looking to rebuild their credit.

What if I have poor credit?

You can still apply! The loan aims to help improve your financial situation.

How does it help my credit?

Making regular, on-time payments can help you build a positive credit history, which boosts your credit score. The Credit Essentials sessions will also provide valuable tips to help you manage your finances wisely!

How long can I take to repay the loan?

The term for repayment is 12 months. This shorter term helps you stay on track with a consistent repayment pattern.

What happens if I miss a payment?

We understand that life happens! However, if you miss a payment, it could result in a late charge. To avoid this, we recommend setting reminders or automatic payments to help you manage your loan smoothly. If you do not pay within 30 days, your loan will be settled using your secured shares, which helps protect your credit score. Just remember, you might need to pay more than the secured amount due to interest.

If I don't pay on time, will there be a late charge?

If payment is not received in full within 10 days after it is due, you will pay a late charge of 5% of the payment that is due, with a minimum of $10.00.

What happens if I pay off my loan early?

You’re welcome to pay off your loan early! Just keep in mind that it may not lead to an increase in your credit score.

Can I apply for this loan if I have other loans?

Absolutely! You can still apply for our loan even if you have other loans, as long as you meet our eligibility criteria and are comfortable managing your repayments.

Can I have a co-borrower?

Unfortunately, no. But the good news is that each person can apply for their own SmartScore loan to build credit individually!

Why choose SmartScore?

Our SmartScore program provides the opportunity for you to build your credit score while you save money that will be earned back at the end of the program.

{endAccordion}

Ready to get started?

If you are interested in learning more, please click "learn more" to provide us with your contact information. If you are ready to apply now, please click "apply now."

If you have any questions, please call (808) 933-6700. We're excited to support you on your journey to better credit!

*Your credit score will depend on your timely payments and financial habits. Results cannot be guaranteed. Please note that this product will not eliminate any negative credit history from your credit report.

1APR=Annual Percentage Rate. Applicants must qualify under CU Hawaii’s membership and lending guidelines. Rates are subject to change. Loan rate of 5.00 effective 07/01/2025. Your Membership Savings account is used as collateral for your SmartScore loan. As of 07/01/2025, the APY (Annual Percentage Yield) for a Membership savings account is 0.05% and is subject to change without notice. Payment example: A loan of $300 with 5.00% APR with a 12-month term will have 12 monthly Principal and Interest payments of $25.69, which includes $8.28 total interest paid. A loan of $5,000 with 5.00% APR with a 12-month term will have 12 monthly Principal and Interest payments of $428.08, which includes $136.96 total interest paid. After successful repayment of the loan, the balance in your Membership Savings account will be made available. If you fall 30 days delinquent, your SmartScore Loan will be settled and closed, using the funds previously pledged in your Membership Savings account. Certain restrictions apply. Insured by NCUA